About Our Loan Payment Calculator

Are you planning to borrow a loan but need a clear cut clarification on the monthly dues? Don't worry; our loan payment calculator is here to help!

Well, no matter whether you are considering getting a loan for a car, house, personal expenses, or any other purpose, our designed payment calculator will certainly come up with the precise results that will help you make a smart decision.

Let us take you to more detailed information; look at how this powerful tool works!

What is a Fixed Term?

A fixed term refers to the predetermined length of time you are obligated to make regular payments on your loan. This term is typically expressed in months or years. Choosing a fixed term will determine how long it will take to pay off the entire loan while allowing you to plan your finances accordingly.

What is a Fixed Monthly Payment Amount?

A fixed monthly payment is the consistent sum you pay monthly towards your loan. It involves the principal i.e., the total amount borrowed and the interest i.e, The rate charged on it. With a fixed monthly payment, you can anticipate the same amount due every month, making budgeting easier and more manageable.

How Does the Payment Calculator Work?

- Click here to Visit our website, where the Payment Calculator is available.

- Enter the total amount of the loan you consider to borrow. This is the initial principal amount.

- Enter the value of the interest rate applicable to the loan.

- Choose the duration of the loan in months or years. This represents the fixed term over which you will make regular payments.

- Now, Click "Calculate" to start the calculation.

- Take note of the monthly payment amount displayed on the screen. This figure represents the fixed monthly payment you can expect to make towards your loan.

Benefits of Using the Payment Calculator.

There are several benefits you can have using the payment calculator, such as,

Accurate Estimates: The payment calculator provides precise calculations, ensuring you have a realistic understanding of your loan payments.

Financial Planning: Knowing your monthly payment amount in advance allows you to plan your budget effectively and avoid any financial surprises.

Comparison Tool: Easily compare different loan options by inputting various interest rates, loan terms, and amounts to determine the most suitable choice for your needs.

How Do You Calculate a Loan Payment?

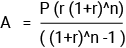

Calculating a loan payment needs attention to three key factors, namely: the amount of the loan, the interest rate, and the term of the loan. By putting the value of these three in the loan payment formula, you can effortlessly calculate the loan payment.

Formula:

Where,

A = Payment amount per period

P = Initial principal or loan amount

r = Interest rate per month

n = Total number of months

What Are the Types of Loans?

Here are different types of loans available to meet different financial requirements,

Personal Loans: The loan that people use for personal expenses, such as home renovations, medical bills, or debt consolidation.

Auto Loans: Specifically designed for purchasing vehicles, either new or used.

Mortgages: Loans used to finance the purchase of a home or property.

Student Loans: Aimed at assisting students in funding their education and related expenses.

Explain Secured Vs. Unsecured Loans.

Secured Loan:

In a secured loan, a borrower has to mortgage any valuable property to the lender to get a loan. You may mortgage a car, jewelry, house, or other property. This is also known as collateral. The collateral acts as a protection for the lender if the borrower fails to repay the loan. In default, the lender has the legal right to seize that collateral and sell it to recover the loan amount lent. By requiring collateral, lenders reduce their risk and increase the likelihood of recovering their funds.

The most comforting prospect is you can avail the secured loan with lower interest rates and higher borrowing limits as they are less risky. Mortgages, auto loans, secured personal loans are some examples of secured loans.

Unsecured Loan:

An unsecured loan is one in which a borrower does not require to mortgage any property. The lender grants a loan to the borrower by checking the creditworthiness of the borrower, his/her income, and ability to repay. Unsecured loans provide a higher risk to lenders since they lack security, resulting in higher interest rates and lower borrowing limits when compared to secured loans. Personal loans, student loans, credit cards, signature loans, peer-to-peer loans are some examples of unsecured loan.

What Are the Loan Basics?

Understanding the basics of loans is essential before diving into the borrowing process. Here are a few key points to keep in mind:

- Principal: The initial amount borrowed from the lender.

- Interest: A fixed percentage of the loan amount is charged as a cost of borrowing money.

- Loan Term: The total duration over which the loan is repaid, typically measured in months or years.

- Annual Percentage Rate (APR): It is the annual cost of borrowings that includes interest, and any other applicable fees.

- Repayment Schedule: The predetermined schedule outlining the timing and amount of each loan payment over the loan term.

- Late Payment Fees: When the borrower fails to make the timely payments, the lender charges the penalty on it.

- Prepayment Penalties: It is the penalty imposed when the borrower makes the entire payment of loan before the agreed-upon term.

How to Calculate Personal Loan EMIs?

Personal loan EMIs (Equated Monthly Installments) can be calculated using the loan payment formula mentioned earlier. You can determine your monthly EMI by inputting the loan amount, interest rate, and loan term into the formula.

What Factors Affect Personal Loan EMIs?

There are several factors that create an impact on personal loan EMIs such as the loan amount, rate of interest, loan duration, frequency of EMI payments, processing charges, other additional charges related to loan etc.

How is the Personal Loan Interest Rate Calculated?

The personal loan interest rate is calculated on various factors involving the borrower's creditworthiness, income, loan amount, and prevailing market rates.

Can You Explain the Personal Loan Amortization Schedule?

A personal loan amortization schedule is a systematically elaborated table that shows the repayment plan for the loan. It embraces information about each payment, such as the principal amount, interest paid, and the outstanding balance.

This loan payment calculator will help you calculate your monthly payments conveniently, estimate the interest you will pay over the loan term, and plan your finances accordingly. Take the privilege of this valuable tool to make smart decisions about your borrowing needs.

The wise choice while committing to a loan is always a good option. For that, you must have proper knowledge of the entire concept of the loan thing. Determine your financial status, know the risks and privileges and pick the best loan option that aligns with your capability and need.

Don't let uncertainty cloud your loan decisions. Use our loan payment calculator today and gain clarity on your monthly payments, empowering yourself to make smarter financial choices.

History